As the world confronts rising temperatures, extreme weather, and mounting economic risk, decisive action is needed today to secure a healthy planet for future generations. Investing in climate solutions offers both environmental and financial rewards, transforming challenges into opportunities for innovation, resilience, and growth.

Climate change is no longer a distant threat. Experts warn that failing to limit warming could cost 11–14% of global GDP by mid-century. The gap between current emission trajectories and the targets needed to stay below 2°C warming is a staggering 12–15 Gt CO₂e, while the more ambitious 1.5°C goal demands cutting 29–32 Gt CO₂e—equivalent to the six largest emitters combined.

Today, only 0.8% of Earth’s land endures average temperatures above 29°C. Without swift mitigation, up to three billion people may face these “unbearable temperatures” by 2070. Moreover, fossil fuel production is rising by 2% annually instead of the 6% yearly reduction required, and plastic output is on track to quadruple by 2050—exacerbating greenhouse gas emissions throughout its lifecycle.

With the 1.5°C target deadline looming—requiring emissions to peak before 2025 and drop by 43% by 2030—every delay compounds future risks. There is a 93% chance that one of the years between 2022 and 2026 will set a new global heat record, underscoring the necessity for immediate action.

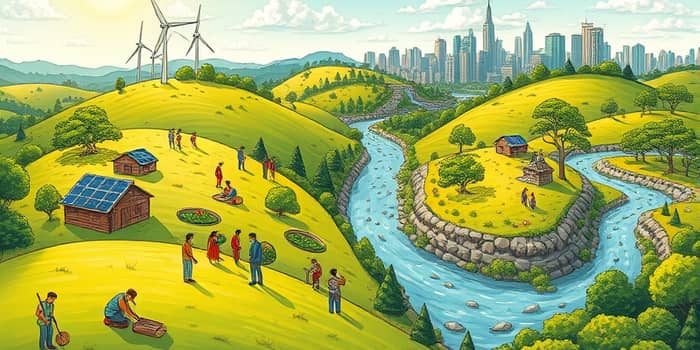

Mitigation efforts aim to curb greenhouse gas emissions at their source. A shift toward renewable energy stands central to these actions. By reallocating capital into solar, wind, and geothermal infrastructure, we can displace fossil fuels and lower emissions rapidly.

These measures require robust policy frameworks, technological innovation, and public and private investment to achieve the scale necessary for impact.

Even with aggressive mitigation, some climate impacts are now unavoidable. Adaptation strategies help communities and ecosystems withstand rising sea levels, extreme weather, and shifting agricultural zones.

Adaptation not only protects lives and livelihoods but also preserves the gains from mitigation efforts, ensuring communities remain vibrant and productive in a changing climate.

Investors play a pivotal role in driving the transition to a low-carbon economy. A diverse array of financial instruments and approaches can channel capital toward climate solutions.

Emerging policy frameworks like the EU Taxonomy provide clarity on what qualifies as sustainable activity, helping investors align portfolios with the UN Sustainable Development Goals, especially SDG 13: Climate Action.

The United Nations Environment Programme identifies six sectors where targeted action yields transformative results. Coordinated investment in these areas can deliver comprehensive emissions reductions and foster resilient communities.

Despite the clear benefits, obstacles remain. Political inertia, vested interests, and technology gaps—especially in carbon capture—hinder progress. Current climate financing falls far short of the trillions needed each year.

However, these challenges also present opportunities. The rise of corporate climate disclosures incentivizes transparency. Financial incentives and green taxonomies direct capital toward low-carbon sectors. The booming market for plant-based and sustainable products reflects consumer demand for ethical choices.

By leveraging innovation—such as advanced battery storage, hydrogen energy, and sustainable aviation fuels—investors can support the next wave of climate solutions while achieving competitive returns.

Time is of the essence. Every year without decisive action locks in greater costs, greater risks, and more severe impacts. Yet investing in climate solutions is not just a moral imperative; it is an economic opportunity that drives growth, spurs innovation, and safeguards assets.

Achieving a greener planet demands multi-pronged action: robust policy frameworks, targeted investments, technological breakthroughs, and collective behavior change. Governments, businesses, communities, and individuals must unite behind a shared vision of sustainability.

As investors, we hold the power to direct capital flows toward a resilient, low-carbon future. By prioritizing renewable energy, sustainable agriculture, resilient infrastructure, and nature-based solutions, we can help steer the world toward the stability and prosperity that only a healthy planet can provide.

The path ahead is clear. Let us embrace the solutions at our disposal and invest boldly in the planet we all call home.

References